“In everything we do, we are driven by the belief that truth is more important than conformity. The way we challenge conformity with truth is by driving advancement in applied mathematical econophysics. We just happen to create portfolios that generate exceptional risk-adjusted performance.”

- Benjamin D. Summers

OUR ARCHITECTURE

Where a first-principles research mandate governs the management of institutional capital

Mathematical physics operates on first principles and empirical proof; institutional finance largely operates on consensus and convention. Adagio Group was founded to apply the discipline of the former to the domain of the latter. This foundation is expressed through our institutional architecture, which is defined by three governing principles:

1. A First-Principles Definition of Risk. We reject variance as a proxy for risk. Our methodologies are built from the mathematical definition of risk: the probability of loss weighted by the expected degree of loss. This is not a preference; it is a logical necessity for navigating markets that exhibit non-Gaussian behavior, particularly during crises.

it's not a feeling. Risk is a number:

it's the probability of loss weighted by

the expected degree of loss.

2. Markets as Complex Adaptive Systems. We recognize that markets are not efficient equilibrium machines. They are complex systems that generate persistent signals and structural patterns invisible to conventional analysis. Our framework is designed to detect these signals across multiple time scales and market regimes, from quiet periods to sudden liquidity events.

3. A Closed-Loop Intellectual Architecture. Our OCIO platform is the direct output of fundamental research from our capstone entity, Adagio Institute. Theoretical breakthroughs in econophysics and financial mathematics are engineered into deployable strategies. In turn, market data from our platform continuously stress-tests and refines our theoretical models. This creates a new standard of empirically-validated performance.

“[Most] investors may be quite willing to take the risk of being wrong in the company of others, while being much more reluctant to take the risk of being right alone.”

- John Maynard Keynes

OUR PLATFORM

An integrated intellectual architecture for institutional investment built on a foundation of first principles

Our work with a select group of university endowments and family offices is defined by a single, end-to-end process. This platform is the operational expression of our core premise, ensuring that our intellectual framework is applied with institutional discipline at every stage. This architecture is comprised of three integrated components:

1. Foundational Research: The Adagio Institute

Our platform is the direct output of fundamental research from our capstone entity, the Adagio Institute. Theoretical breakthroughs in econophysics and financial mathematics are engineered into deployable strategies. In turn, market data from our platform continuously stress-tests and refines our theoretical models. This Closed-Loop Intellectual Architecture creates a new, proprietary standard of empirically-validated performance.

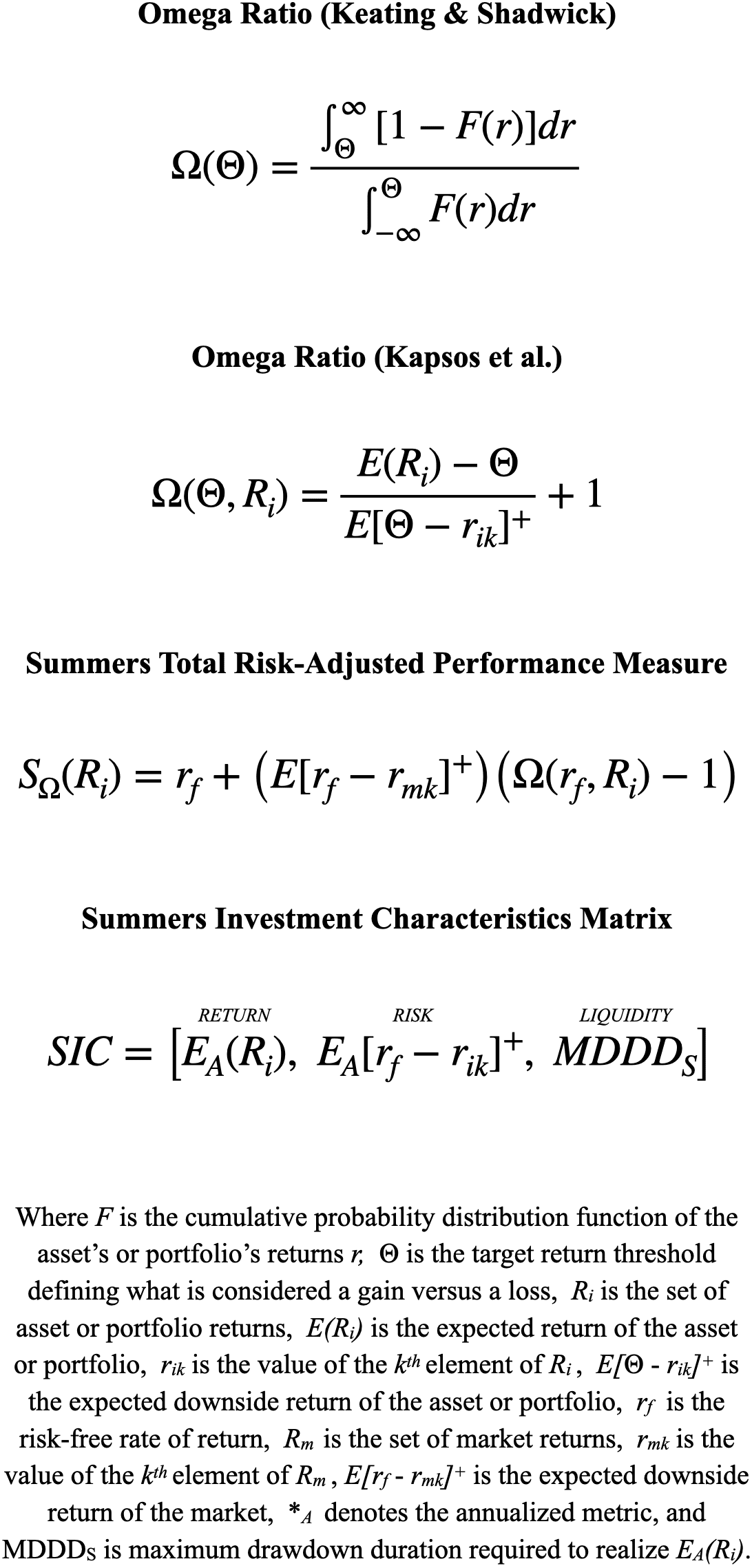

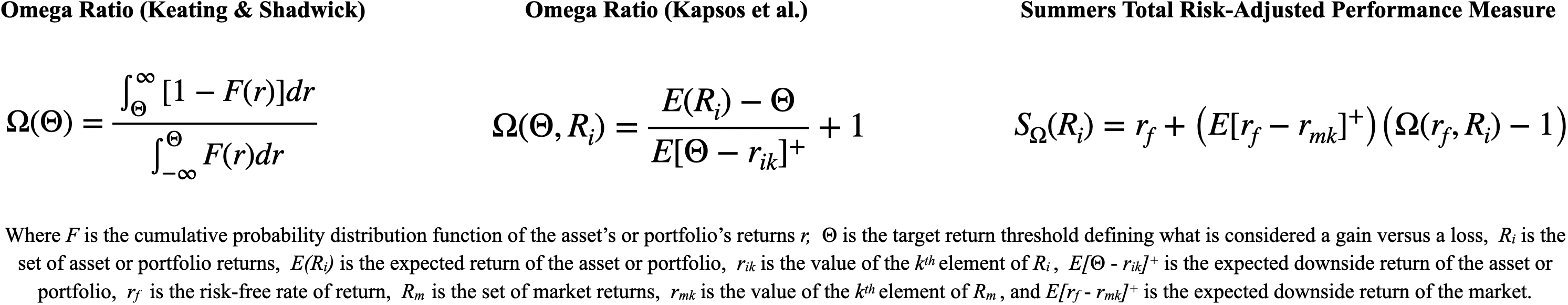

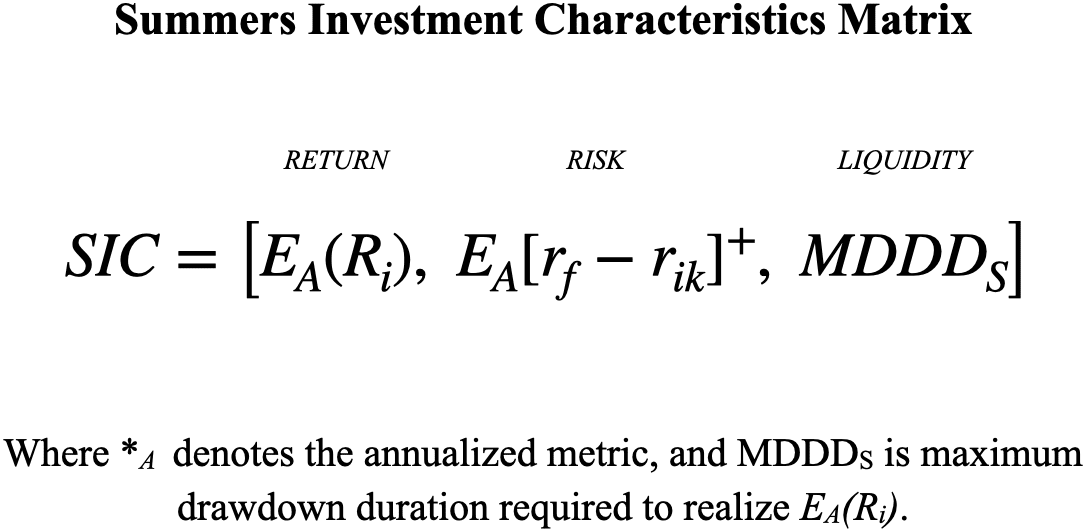

Summers MEASURE & INVESTMENT CHARACTERISTICS MATRIX

Rigorous quantitative analysis is unequivocally the only responsible method of determining asset quality and informing portfolio construction. Of the risk-adjusted performance measures, the Summers Total Risk-Adjusted Performance Measure is the only one that captures all four statistical moments while providing a user-friendly output as a percentage relative to the market. The Summers Investment Characteristics Matrix paints an accurate, comprehensive picture of the risk, return, and liquidity characteristics of any asset or portfolio regardless of asset class—from equities to real property.

2. First-Principles Portfolio Engineering

Our quantitative engineering desk translates our foundational research into an active investment process. We engineer investment products and portfolios from first principles, translating advanced mathematical frameworks into robust, operational code that implements techniques from signal processing, dynamic mode decomposition, and neural network integration. This engineering process involves several core applications:

- Multidimensional Risk Assessment: Utilizing proprietary frameworks like the Omega Ratio and the Summers Investment Characteristics (SIC) Matrix to capture the complete return distribution.

- Dynamic Allocation: Employing Bayesian signal integration to adapt to evolving market conditions, as demonstrated by the adaptive weighting of signals in our research.

- Systematic Performance Verification: Measuring all outcomes against the Summers Total Risk-Adjusted Performance Measure (Summers Measure), a true, comprehensive standard of risk-adjusted performance.

- Bespoke Product Engineering: Designing private structured products for qualified institutional partners who require risk-defined solutions for specific mandates.

3. The Outcome: A New Standard of Fiduciary Governance

Our platform delivers a level of transparency that transcends narrative explanations. The result for our partners is unambiguous, quantitative attribution and a comprehensive decomposition of risk. This allows a governing body to fulfill its fiduciary duty with a complete and empirically-validated understanding of its portfolio, establishing a new and superior standard of institutional governance.

“How much you truly 'believe' in something can be manifested only through what you are willing to risk for it.”

- Nassim N. Taleb

THE PRINCIPALS

Benjamin D. Summers

Managing Director & Founder

Ben is the founder and managing director of Adagio Group, where he has built an innovative institutional OCIO model grounded in his transdisciplinary research in financial mathematics, econophysics, and financial engineering. This first-principles framework provides the quantitative engine for the firm's portfolio management and the analytical foundation for its comprehensive services—from investment policy development to robust, data-driven governance—for the family office and endowment space.

Ben’s non-traditional path, including careers as a professional athlete with the San Diego Padres and an executive in global energy services, provides a differentiated perspective on discipline, risk, and strategic decision-making. He holds a BS in Physics from LSU with a second discipline concentration in Music and is completing his PhD by Published Works. A member of the Forbes Finance Council, Ben is also the author of the #1 bestseller, The Shadow Banker's Secrets: Investment Banking for Alternatives.

Dr. Kurtay Ogunc

Director - Academic Affairs

Kurtay is responsible for academic initiatives under Adagio Institute providing senior guidance on the firm's research and institutional initiatives. He is also the Director of Undergraduate Studies & Research, Director of the Asset Management Academy, and Director of the Quantitative Finance Club in the department of finance at LSU.

In addition to his academic career, Kurtay has served in the public and private sectors over the last three decades, most recently as the Senior Investment Officer for Risk Management and Asset Allocation in the Mayor’s Office for Pensions and Investments at the New York City Retirement System. Additionally, Kurtay served as the first investment manager for the LSU endowment.

Kurtay received his PhD in Decision Sciences (Asset Management, Stochastic Processes and Econometrics) and Master of Applied Statistics (Binary Choice Models and Bayesian Theory) from LSU and his MBA in Finance from Western Michigan University.

“I want a guy who knows enough math so that he can use those tools effectively but has a curiosity about how things work and enough imagination and tenacity to dope it out.”

- Jim Simons

CAREER OPPORTUNITIES

Careers at Adagio

Adagio Group is not a conventional financial institution. We operate at the intersection of mathematical physics and institutional finance. Our technical talent is developed exclusively through the rigorous curriculum of our research affiliate, the Adagio Institute. Our partnership ranks are reserved for a different but equally rare skill set. We are in continuous dialogue with established leaders who possess the deep network and political capital to navigate the highest levels of institutional finance, and the intellectual horsepower to operate as a peer in a first-principles environment.

A Note for Future Principals

Our model requires a small number of principals who can function as trusted, confidential advisors to the boards and investment committees of major institutional allocators. This is not a sales or distribution role. It is a long-term, strategic function built on unimpeachable integrity, a history of institutional success, and a fundamental alignment with our mission to challenge the flawed conventions of the investment industry. This path is reserved for individuals whose professional history and intellectual framework are self-evident.

To Initiate a Private Dialogue

For those who recognize themselves in this description, we maintain an open and confidential channel for principal-to-principal discussions.

EQUAL OPPORTUNITY EMPLOYER DISCLOSURE: It is the policy of Adagio, LLC to ensure equal employment opportunity without discrimination or harassment on the basis of race, color, religion, creed, age, sex, gender, gender identity or expression, sexual orientation, national origin, citizenship, disability, marital and civil partnership/union status, pregnancy (including unlawful discrimination on the basis of a legally protected pregnancy/maternity leave), veteran status, genetic information or any other legally protected characteristic.

“An investment in knowledge pays the best interest."

- Benjamin Franklin

INSIGHTS & RESEARCH

The Briefing Room

For principals of endowments, family offices, and other institutional allocators, this collection contains the foundational research and strategic frameworks that govern our platform.

The Intellectual Foundations (Core Research)

An Intuitive True Total Risk-Adjusted Performance Measure and Characteristics Matrix

Technical paper for practitioners introducing a suite of proprietary metrics, including the Summers Measure and the SIC Matrix, that provide a complete, mathematically robust method of portfolio analysis.

The Standand Model of Complex Economic Systems

Mathematical econophysics paper introducing a unified framework that integrates signal processing, operator theory, and Bayesian inference to model financial markets with empirical rigor.

Adagio Institute, Inc.

501(c)(3) public charity whose mission is to advance mathematical physics through rigorous graduate standards and foundational research, securing long-term financial autonomy for deserving work through applied econophysics and financial mathematics.

Adagio Institute, Inc.

501(c)(3) public charity whose mission is to advance mathematical physics through rigorous graduate standards and foundational research, securing long-term financial autonomy for deserving work through applied econophysics and financial mathematics.

The Institutional Framework

The Public Narrative

The Public Narrative

From the Founder's Desk

For the broader community of accredited investors, RIAs, and financial professionals, Benjamin Summers wrote the international bestseller The Shadow Banker's Secrets and provides ongoing commentary on markets, risk, and the first principles of investment through his Substack newsletter of the same name. With over 100,000 accredited investors and 10,000 institutional representatives, it is a leading platform for sophisticated, unconventional financial analysis.

The Shadow Banker's Secrets

INVESTMENT BANKING FOR ALTERNATIVES

Benjamin D. Summers

Foreword by Oren Klaff

Protect Your Portfolio from Market Crises

While Generating Above-Market Returns, Create Capital and

Become Your Own Bank

The Shadow Banker's Secrets

CUSTOM JAVASCRIPT / HTML

The Shadow Banker's Secrets

Benjamin D. Summers

Foreword by Oren Klaff

Protect Your Portfolio from Market Crises

While Generating Above-Market Returns,

Create Capital and Become Your Own Bank

#1 INTERNATIONAL BESTSELLER IN 9 INVESTING & FINANCE CATEGORIES

CUSTOM JAVASCRIPT / HTML

The Standard Model of Complex Economic Systems [WORKING PAPER]

March 2025

(This working paper presents the comprehensive theoretical and empirical framework underlying Adagio Group's successful investment strategies, now being transitioned to academic publication. Components of this framework are being prepared for submission to peer-reviewed journals.)

This paper introduces a comprehensive theoretical framework termed ”The Standard Model of Complex Economic Systems” that bridges econophysics, signal processing, and portfolio theory using Hilbert space methods. We develop a unified approach that integrates fundamental analysis with sophisticated quantitative methods, applying Bayesian inference in function spaces to signals extracted from spectral analysis, wavelet decomposition, and operator-theoretic analysis of financial time series. The primary objective is to optimize the Omega ratio for leveraged liquid assets that have passed specific fundamental screening criteria. This dual-methodology approach addresses a significant gap in current practice: fundamental analysis establishes intrinsic value baselines while Hilbert space methods identify market signals that enable predictive modeling of period total returns. We introduce the Summers Total Risk-Adjusted Performance Measure (Summers Measure) with functional extensions that provide improved interpretability while preserving higher-moment sensitivity. Empirical testing demonstrates that our approach significantly outperforms traditional optimization techniques, particularly during market regime transitions and periods of high volatility. The framework contributes to the theoretical understanding of financial markets as complex adaptive systems while offering practical applications for investment management. By providing a physically interpretable model of market dynamics grounded in functional analysis, this paper establishes a foundation for a new paradigm in quantitative finance.

An Intuitive True Total Risk-Adjusted Performance Measure and Characteristics Matrix

January 2023

Keating and Shadwick’s Omega ratio captures all statistical moments of return distributions but has practical limitations with respect to portfolio optimization. Kapsos et al. simplified the Omega ratio into an expression with better practical application, but its focus as a portfolio optimization tool represents a trade-off with respect to absolute risk-adjusted performance measurement. First, we've transformed the Kapsos form of the Omega ratio in an analogous manner to what Modigliani did with the Sharpe ratio to create an intuitive percentage output scaled against the market. Second, we’ve deconstructed the Kapsos form of Omega to create a 3 x 1 matrix that measures and intuitively communicates the three fundamental characteristics that define an investment: risk, return, and liquidity.

Be a Better Fiduciary: Private Structured Products & Quantitative Risk Analytics for Financial Advisors

February 2018

(This paper details the core philosophy behind our use of bespoke private structured products. While originally framed for financial advisors, its central argument on the duties of a modern fiduciary is directly applicable to institutional allocators. It establishes the 'why' for this critical component of our platform. The specific 'how'—the proprietary engineering of these solutions—is now governed by the more advanced frameworks detailed in our core research, such as the Summers Measure and the SIC Matrix.)

Most financial advisors adhere to a very traditional asset allocation model built entirely upon public securities. Outside of the fact that a set of relatively vague, qualitative criteria govern the literal value of their clients’ life work, the substance upon which those models are predicated is a set of assets completely dependent upon schizophrenic secondary markets...

Investment Banking for Private Real Estate Operators

June 2017

Investment banks are intermediaries that, amongst many other functions, help typically large companies raise capital by advising on and underwriting new securities issues. To prepare for a new issue of securities, investment banks first advise their clients on considerations such as capital structure (how much debt vs. equity should be issued; what types of equity and debt should be issued, etc.), the strategic use of other financial instruments (such as warrants), and...

Investment Clubs: Gain the Exclusive Access of the Top 1%

May 2017

There is a little-known solution that can afford non-accredited investors the opportunity to participate in the exclusive securities offerings of hedge funds and invest like the top one percent: the investment club. An investment club is a business entity structured as either a general partnership or LLC in which all members (owners) are also managers who participate by vote in determining the investment decisions of the club; because all owners actively participate...

Constructing Alpha: An Introduction to the Fundamentals of Risk

April 2017

Every investor — from the guy who bets on physical currency by hiding it under his mattress to Ray Dalio — is concerned with risk. Somewhat surprisingly, despite the fact that the vast majority of people are risk averse, very few have any idea what risk actually means or how to measure it… this group includes many, if not most, financial professionals. Ironically, despite retail investors’ often stated aversion to risk, they tend to solely focus on the projected return...

From Wall Street to Main Street

July 2016

Most real estate investors face the nearly impossible task of competing for the few quality deals in their market against tens, if not hundreds, of deep-pocketed, well-connected and established investors already there. To survive, new and undercapitalized investors are forced to work many fruitless hours blindly mailing, calling, driving and knocking on random doors to find whatever scraps may be left over. After all this effort, in the rare instance a good deal is finally secured...

Introduction to Options in Real Estate

January 2015

One of most prolific and powerful tools of “creative” finance in real estate is the lease-option, but this tool represents only the proverbial tip of the iceberg when it comes to the most powerful breed of derivatives in the investing world, options. There are two basic types of options: the call option (or “call”) and the put option (or “put”). A call is what is utilized in the traditional lease-option; the put, on the other hand, is virtually unheard of in the world or real estate. An option...

Determining Equilibrium Value for Residential Real Estate

March 2013

(This paper serves as a foundational case study in the Adagio methodology. It demonstrates how we dismantle a conventional, narrative-based valuation model ("comparable sales") and replace it with a rigorous, first-principles framework derived from corporate finance. The subject is real estate; the principle is universal.)

One of the most pervasive challenges facing the residential real estate market is the determination of property values. As a result of TARP and other federal subsidies to institutional mortgage lenders, in addition to administrative incompetence, the foreclosure pipeline has been clogged. The expected glut of inventory resulting from the mortgage and financial crisis has yet to materialize, and correspondingly, prices have been lifted by artificially limited supply...

Deciphering Monetary Policy as a Means to Beat the Market

October 2012

(This paper details the first-principles critique of the post-1971 monetary order that serves as the foundation of our institutional worldview. While our tactical implementation has since evolved into a comprehensive OCIO platform, the core diagnosis of systemic risk articulated in this document remains our unwavering guide.)

Monetary policy and its effect on the markets can often seem as an impossibly complex, if not opaque dynamic. The market obviously responds, and most often in a seemingly positive manner, to the actions taken by the Federal Reserve System and statements by its chairman, Ben Bernanke… but how and why, and what are the less obvious effects of a centralized monetary system...

ADAGIO, LLC © 2025 All Rights Reserved

5100 Westheimer Rd, Ste 115 • Houston, Texas 77056

LEGAL DISCLAIMER: This site and its content are not an offer to sell, nor a solicitation of an offer to purchase any securities instrument or any interest in Adagio, LLC or its current or future affiliated entities ("Adagio Group").

This website and its contents including any blogs are a publication of Adagio Group. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the topics discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change.

Adagio Group is not a law firm or a broker/dealer. Readers are advised that articles, blog posts and other content are provided solely for informational purposes. The opinions and analyses included herein are based on sources believed to be reliable and written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy, completeness, timeliness, or correctness. Neither we nor any information providers Adagio Group may have engaged shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or any delay or interruptions in, the transmission thereof to the users.

Information on this website and blog do not involve the rendering of personalized investment or legal advice. A professional advisor should be consulted before implementing any investment strategy or transactions. Content should not be construed as financial, legal or tax advice. Always consult an attorney, tax professional or financial adviser regarding your specific legal, tax or financial situation. Investment information is provided without consideration of your financial sophistication, experience, financial situation, investing time horizon, or risk tolerance. Readers are urged to consult with their own independent financial advisers with respect to any investment.

Hyperlinks on this website are provided as a convenience; Adagio Group disclaims any responsibility for information, services, or products found on websites linked hereto. Additionally, Adagio Group is not liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites you are linking to.

Images or mentions of various organizations, services or investments do not represent an endorsement of or by Adagio Group or its affiliates.

PRIVACY POLICY (Effective date: November 16, 2018)

Adagio Group ("us", "we", or "our") operates the theadagiogroup.com website (the "Service"). This page informs you of our policies regarding the collection, use, and disclosure of personal data when you use our Service and the choices you have associated with that data. We use your data to provide and improve the Service. By using the Service, you agree to the collection and use of information in accordance with this policy.

Information Collection And Use

We collect several different types of information for various purposes to provide and improve our Service to you.

Types of Data Collected

Personal Data

While using our Service, we may ask you to provide us with certain personally identifiable information that can be used to contact or identify you ("Personal Data"). Personally identifiable information may include, but is not limited to: email address, first name and last name, and cookies and usage data.

Usage Data

We may also collect information how the Service is accessed and used ("Usage Data"). This Usage Data may include information such as your computer's Internet Protocol address (e.g. IP address), browser type, browser version, the pages of our Service that you visit, the time and date of your visit, the time spent on those pages, unique device identifiers and other diagnostic data.

Tracking & Cookies Data

We use cookies and similar tracking technologies to track the activity on our Service and hold certain information. Cookies are files with small amount of data which may include an anonymous unique identifier. Cookies are sent to your browser from a website and stored on your device. Tracking technologies also used are beacons, tags, and scripts to collect and track information and to improve and analyze our Service. You can instruct your browser to refuse all cookies or to indicate when a cookie is being sent. However, if you do not accept cookies, you may not be able to use some portions of our Service. Examples of cookies we use: session cookies to operate our Service; preference cookies to remember your preferences and various settings; and security cookies for security purposes.

Use of Data

Adagio Group uses the collected data for various purposes to: provide and maintain the Service; notify you about changes to our Service; allow you to participate in interactive features of our Service when you choose to do so; provide customer care and support; provide analysis or valuable information so that we can improve the Service; monitor the usage of the Service; and detect, prevent and address technical issues.

Transfer Of Data

Your information, including Personal Data, may be transferred to—and maintained on—computers located outside of your state, province, country or other governmental jurisdiction where the data protection laws may differ than those from your jurisdiction. If you are located outside United States and choose to provide information to us, please note that we transfer the data, including Personal Data, to United States and process it there. Your consent to this Privacy Policy followed by your submission of such information represents your agreement to that transfer. Adagio Group will take all steps reasonably necessary to ensure that your data is treated securely and in accordance with this Privacy Policy and no transfer of your Personal Data will take place to an organization or a country unless there are adequate controls in place including the security of your data and other personal information.

Disclosure Of Data

Legal Requirements

Adagio Group may disclose your Personal Data in the good faith belief that such action is necessary to: comply with a legal obligation; protect and defend the rights or property of Adagio Group; prevent or investigate possible wrongdoing in connection with the Service; protect the personal safety of users of the Service or the public; and/or protect against legal liability.

Security Of Data

The security of your data is important to us, but remember that no method of transmission over the Internet, or method of electronic storage is 100% secure. While we strive to use commercially acceptable means to protect your Personal Data, we cannot guarantee its absolute security.

Service Providers

We may employ third party companies and individuals to facilitate our Service ("Service Providers"), to provide the Service on our behalf, to perform Service-related services or to assist us in analyzing how our Service is used. These third parties have access to your Personal Data only to perform these tasks on our behalf and are obligated not to disclose or use it for any other purpose.

Analytics

We may use third-party Service Providers to monitor and analyze the use of our Service.

Google Analytics is a web analytics service offered by Google that tracks and reports website traffic. Google uses the data collected to track and monitor the use of our Service. This data is shared with other Google services. Google may use the collected data to contextualize and personalize the ads of its own advertising network. You can opt-out of having made your activity on the Service available to Google Analytics by installing the Google Analytics opt-out browser add-on. The add-on prevents the Google Analytics JavaScript (ga.js, analytics.js, and dc.js) from sharing information with Google Analytics about visits activity. For more information on the privacy practices of Google, please visit the Google Privacy & Terms web page: https://policies.google.com/privacy?hl=en

Links To Other Sites

Our Service may contain links to other sites that are not operated by us. If you click on a third party link, you will be directed to that third party's site. We strongly advise you to review the Privacy Policy of every site you visit. We have no control over and assume no responsibility for the content, privacy policies or practices of any third party sites or services.

Children's Privacy

Our Service does not address anyone under the age of 18 ("Children"). We do not knowingly collect personally identifiable information from anyone under the age of 18. If you are a parent or guardian and you are aware that your Children has provided us with Personal Data, please contact us. If we become aware that we have collected Personal Data from children without verification of parental consent, we take steps to remove that information from our servers.

Changes To This Privacy Policy

We may update our Privacy Policy from time to time. We will notify you of any changes by posting the new Privacy Policy on this page. We will let you know via email and/or a prominent notice on our Service, prior to the change becoming effective and update the "effective date" at the top of this Privacy Policy. You are advised to review this Privacy Policy periodically for any changes. Changes to this Privacy Policy are effective when they are posted on this page.

Contact Us

If you have any questions about this Privacy Policy, please contact us by email: solutions@adagiollc.com